Fund close marks the largest alternative asset fundraise in blackrock history fund size exceeds original target and fund hard cap.

Blackrock renewable energy infrastructure fund.

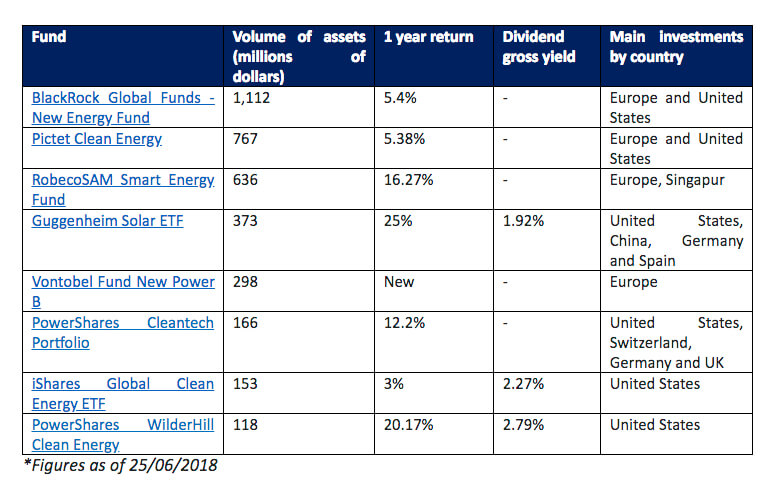

The fund invests globally at least 70 of its total assets in the equity securities of sustainable energy companies.

Grp iii the third vintage of blackrock s global renewable power fund series targets investment in a wide range of climate infrastructure assets with a focus on renewable power generation and energy storage and distribution.

The second launched a few years later brought in 1 65 billion.

The fund was launched at the start of this year with the aim of raising usd 2 5 billion.

The sustainable energy fund seeks to maximise total return.

Blackrock s first renewables private equity fund drew around 600 million of commitments from big investors.

Global renewables power fund iii was launched in the first quarter of this year and is targeting a gross irr of 12 13 percent and a gross yield of 5 7 percent according to pension documents.

The trust seeks to achieve its investment objective by investing primarily in equity securities issued by companies that are engaged in the utilities infrastructure.

Given the scale and urgency of the power and energy transition underway around the world and continuing technical and cost advances we think this trend has a.

New york business wire blackrock s global energy power infrastructure fund gepif has achieved a us 5 1 billion final close of global energy power infrastructure fund iii.

Sustainable energy companies are those which are engaged in alternative energy and energy technologies including.

Global climate infrastructure investments primarily in renewable power seeking financial returns with a purpose.

In infrastructure we expect renewable energy again to be the sector with the most investment activity following a year when it accounted for more than 50 of investment activity.

Blackrock inc is planning to raise 3 5 billion for investments in energy infrastructure in what is poised to be its largest alternative investment fund yet an executive at the world s largest.

Blackrock real assets has begun fundraising for its third global renewables fund targeting 2 5 billion in commitments infrastructure investor understands.

This presents a 9 trillion climate infrastructure.